Carr Inc Purchased Equipment for 100 000

The equipment had an estimated 10-year useful life and a 15000 residualsalvage value. Purchased a 400000 tract of land for a factory site.

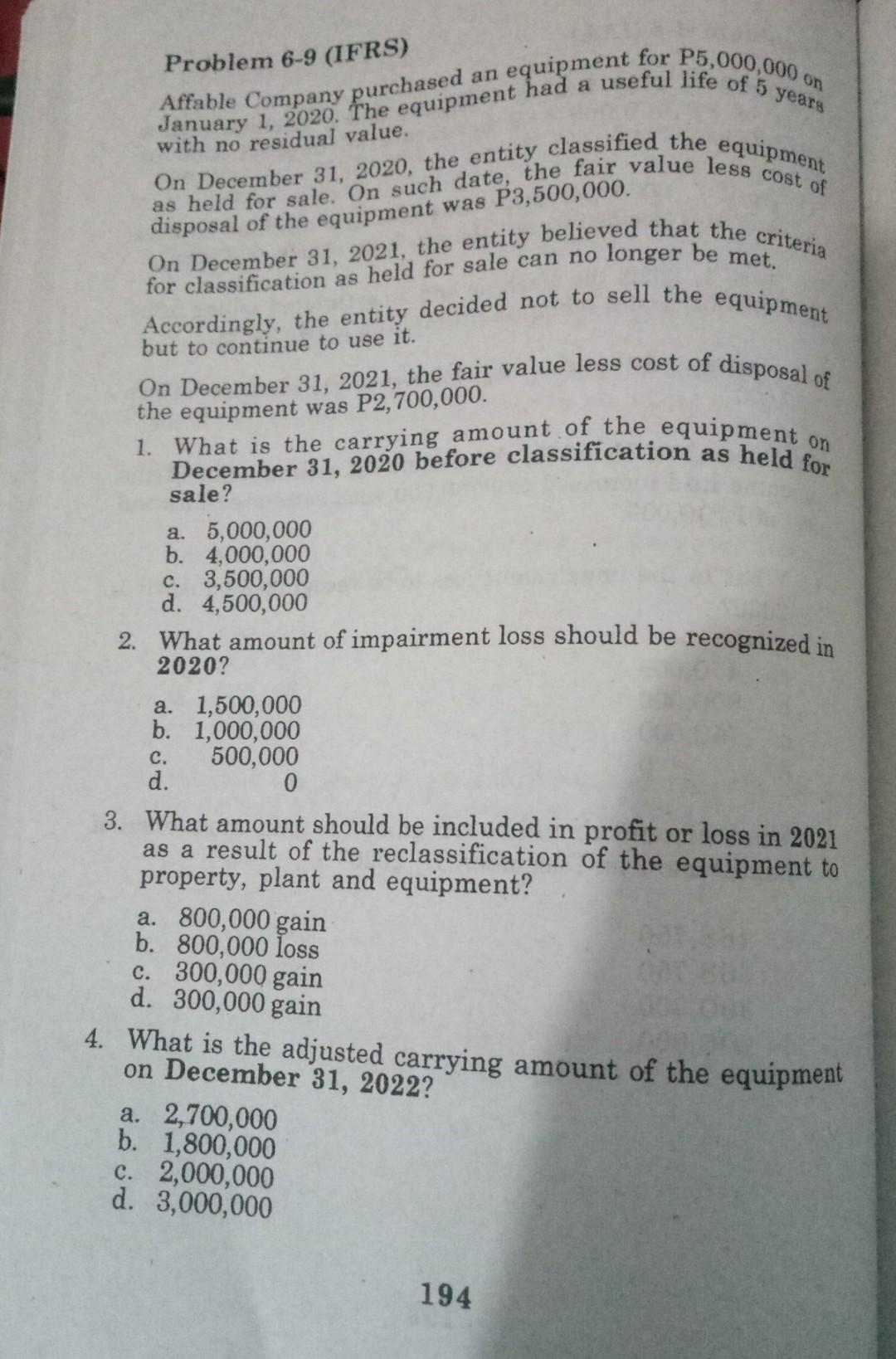

Solved But To Continue To Use It Problem 6 9 Ifrs Affable Chegg Com

The equipment was installed and placed in service on February 1 Year 2.

. Carr Inc purchased equipment for 100000 on January 1 Year 1. The equipment had an estimated 10-year useful life and a 15000 salvage value. Carr uses the 200 declining balance depreciation method.

Carr Inc purchased equipment for 100000 on January 1 Year 1. The equipment had an estimated 10-year useful life and a 15000 salvage value. Join the County of Los Angeles on May 7 for LA County Day at the Fair.

Carr uses the 200 declining balance depreciation method. Under the straight-line method of depreciation what is the assets carryingbook value after three years. The equipment had an estimated 10-year useful life and a 15000 salvage value.

Purchased equipment for 100000 on January 1 year 1. In its Year 2 income statement what amount should Carr report as depreciation expense for the equipment. A 8500 B 25500 C 74500 D 100000 30.

The equipment had an estimated 10-year useful life and a 15000 salvage value. Carr Inc purchased equipment for 100000 on January 1 Year 1. Purchased equipment for 100000 on January 1 year 1.

Carr uses the 200 declining-balance depreciation method. In its year 2 income statement what amount should Carr report as depreciation expense for the equipment. Carr uses the 200 declining balance depreciation method.

Carr Inc purchased equipment for 100000 on January 1 Year 1. Carr Inc purchased equipment for 100000 on January 1 Year 1. Carr uses the 200 declining balance depreciation method.

Boyd razed an old building on it and sold the materials. A Catholic church in Santa Monica was the target of a brazen burglary as thieves made away with more than 100000 in audio and video equipment used for livestreaming services. The equipment had an.

Purchased equipment for 100000 on January 1 2002. LA County Fair Returns May 5-30 The LA County Fair returns in May to celebrate its 100th anniversary. The equipment had an estimated 10-year useful life and a 15000 salvage value.

The equipment had an. The equipment had an estimated 10-year useful life and a 15000 salvage value. Carr Inc purchased equipment for 100000 on January 1 Year 1.

The equipment had an estimated 10-year useful life and a 15000 salvage value. Carr uses the 200 declining- balance depreciation method. Purchased equipment for 100000 on January 1 2002.

The capital equipment was shipped from the vendor on December 31 Year 1 and received by the company on January 5 Year 2. Para reportar llamadas automáticas fraudulentas llama a 800 593-8222. Carr uses the 200 declining balance depreciation method.

Enjoy nostalgic carnival rides and indulge in old-time ice cream and traditional fair favorites. In its 2003 Income Statement what amount should Carr report as depreciation expense for the equipment. Carr uses the 200 declining balance depreciation method.

Carr uses the 200 declining balance depreciation method. Carr uses the 200 percent declining balance depreciation method. In its year 3 income statement what amount should Carr report as depreciation expense for the equipment.

Purchased equipment for 100000 on January 1 2002. Under the straight-line method of depreciation what is the assets carryingbook value after three years. Officials with St.

4 rows Carr Inc purchased equipment for 100000 on January 1 Year 1. Carr uses the 200 declining-balance depreciation method. The equipment had an estimated 10-year useful life and a 15000 residualsalvage value.

A company issued a purchase order on December 15 Year 1 for a piece of capital equipment that costs 100000. On December 1 2005 Boyd Co. Purchased equipment for 100000 on January 1 2009.

The equipment had an estimated 10-year useful life and a 15000 salvage value. Purchased equipment for 100000 on January 1 Year 1. Purchased equipment for 100000 on January 1 year 2.

Carr uses the 200 declining balance depreciation method. In its Year 2 income statement what amount should Carr report as depreciation expense for the equipment. The equipment had an estimated 10-year useful life and a 15000 salvage value.

Up to 25 cash back Carr Inc. The equipment had an estimated 10-year useful life and a 15000 salvage value. A 8500 B 25500 C 74500 D 100000 30.

The equipment had an estimated 10-year useful life and a 15000 salvage value. Purchased equipment for 100000 on January 1 year 1. The equipment had an estimated 10-year useful life and a 15000 salvage value.

Purchased equipment for 100000 on January 1 year 1. The equipment had an estimated 10-year useful life and a 15000 salvage value. Carr uses the 200 declining balance depreciation method.

Far Becker Final Review Flashcards Quizlet

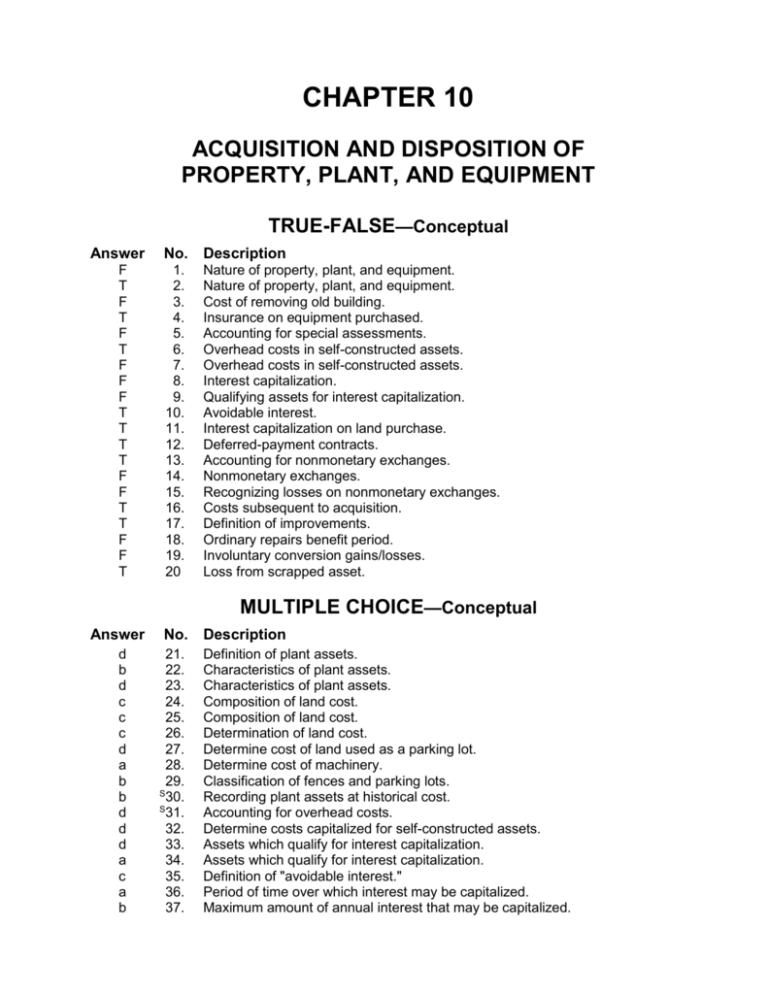

Ch10 Property Plant And Equipment

Solved Selected Data Pertaining To Lore Co For The Calendar Chegg Com

No comments for "Carr Inc Purchased Equipment for 100 000"

Post a Comment